The Wealth of Life

— An interview with Betty Law, Hang Seng’s Head of Corporate Communications and Community Investments

Betty Law of Hang Seng Bank shares her views on managing finances as an essential part of finding balance in life, while redefining the meaning of wealth beyond money.

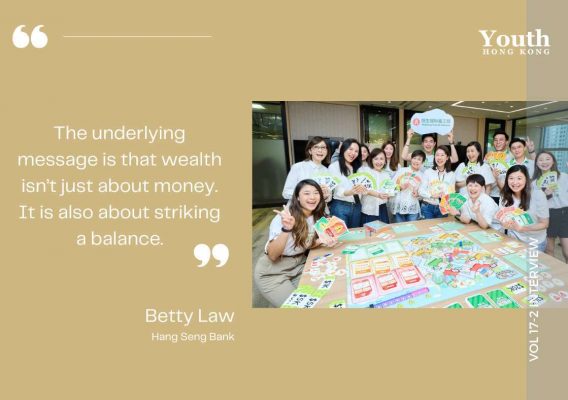

Every stage of life, from childhood to retirement and everything in between, presents its own decisions and challenges, physical, mental and financial. To reflect this in the context of financial education, Hang Seng Bank, in partnership with the Hong Kong Family Welfare Society, has developed a board game called Life Smarts. Reminiscent of Monopoly, this 1.5-hour game helps players of all ages – students, parents, young professionals, and retirees, navigate the thrills and spills of money management.

“The players learn how to make financial decisions while studying, at work or in retirement,” explains Betty Law, Hang Seng’s Head of Corporate Communications and Community Investments. “The underlying message is that wealth isn’t just about money. It is also about striking a balance between financial knowledge, health, wellbeing, and meaningful relationships with friends and family, while being about future planning, especially during earning years and retirement.”

What gives the board game its unique character? It is not just about earning lots of money, with the richest player crowned the winner. Instead, as Betty reveals, the actual winner isn’t the wealthiest but the one who achieves the most balanced, healthy life.

This game is one component of Hang Seng’s broader financial education initiatives, which respond to the rapidly evolving social and digital landscape in Hong Kong. Betty notes, with fast changes in daily life in the city, particularly during the pandemic, teenagers began spending more time at home and their grasp of financial management grew hazier. With the rise of electronic payments, young people now also seldom handle physical cash, and some of them struggle to develop a clear sense of “reasonable spending.”

Hang Seng Bank establish the Hang Seng Financial Volunteer Team to support financial literacy activities, with over 200 staff members sharing financial knowledge to promote financial inclusion within the community.

Recognising these challenges, Hang Seng Bank has made financial education a priority. “We believe that in the digital age, fostering healthy financial values in the younger generation is crucial,” says Betty. “We have a corporate social responsibility to help all sectors of society build sound financial awareness.”

As a result of this forward-looking strategy, last year, the Bank formally established the Hang Seng Financial Volunteer Team to support financial literacy activities, with over 200 staff members sharing financial knowledge to promote financial inclusion within the community.

Additionally, Hang Seng is the Strategic Financial Services Partner for JC PROJECT LIFT, an initiative by The Hong Kong Jockey Club Charities Trust. This programme empowers underprivileged families with tailored financial education and services to help them break free from the poverty cycle. “We’ve observed that residents in transitional housing and low-income families often have a limited understanding of financial management,” Betty says. “Through workshops and sharing sessions, we show them how even small amounts of savings can grow into meaningful wealth.”

Hang Seng Bank, in partnership with the Hong Kong Family Welfare Society, has developed a board game called Life Smarts.

This is not Hang Seng’s only community project. In the 2023/2024 academic year, the Bank partnered with the Hong Kong Family Welfare Society to launch the Hang Seng Financial Literacy Academy and held more than 170 events that reached over 10,000 primary and secondary students, parents and social workers.

These events proved very helpful when explaining the difference between “wants” and “needs,” especially to young people, but as Betty notes, it is something we could all learn.

Another activity involved the Bank taking over 30 secondary students to visit the International Finance Centre and the Hong Kong Monetary Authority. Not only did the visit provide first-hand exposure to the financial world and, it also helped bridge the gap between finance professionals and the wider community.

Wealth isn’t just about money. It is about striking a balance.

“Through all these activities, we want young people to understand that wealth isn’t just about money,” Betty adds. “It’s about making the most of the resources you already have.”

Hang Seng believes that everyone, regardless of economic status, should have access to basic financial services. From grassroots families to young people and the elderly, the Bank sees promoting financial literacy as a shared responsibility.

Betty emphasises that companies like Hang Seng have a duty to promote financial literacy in the community. While many schools and parents already provide financial education, Betty encourages a more structured, multi-party collaboration between businesses and NGOs. Reiterating the goals of the partnership with the Hong Kong Family Welfare Society as a successful model, where financial education is woven into school curriculum, rather than treated as an extracurricular activity. “This ‘Business-NGO-education sector’ model,” she says, “really is able to deliver more systematic financial education.”

Betty outlines three key ways the Bank aims to support financial education in Hong Kong: upholding the principles of financial literacy and inclusion, providing funding and professional support through volunteer financial advisors, and collaborating with organisations to maximise impact. “Making financial education work effectively is critical for Hong Kong’s future,” Betty concludes, “and we’re committed to being part of the solution.” ■